Published 2 March 2022 – ID G00751074 – 10 min readBy Christophe Uzureau, David Furlonger

Overview

Key Findings

- The combination of underlying factors — socioeconomic, technologic and financial — driving the issuance and exchange of digital business assets (DBAs) is disrupting existing monetary and commercial exchanges, and customer engagement.

- The number of DBA classes is increasing, creating confusion and strategic blind spots for financial services providers.

- The emergence of new DBAs highlights the inadequacy of financial services providers’ IT strategies to meet the competitive demands of digital transformation.

Recommendations

Financial services CIOs planning their digital business strategy should:

- Analyze the impact of DBAs on your market by assessing the underlying factors driving the issuance, usage and exchange of DBAs.

- Engage with your business peers on the impact of the different asset classes on product and service development, customer engagement, and risk management by using the Gartner Digital Business Asset Taxonomy to define the architecture and infrastructure implications.

- Analyze the viability of existing systems by undertaking a technology capability assessment to evaluate if those systems can engage with and process DBA transactions as well as support tokenization of existing asset classes.

Introduction

Digital Business Asset TaxonomyGartner clients are increasing the number of questions they submit about DBAs and their future role in commerce and customer engagement.A digital business asset (DBA) is anything that is stored or represented digitally and is uniquely identifiable that organizations can use to realize value. The asset or underlying good can include a physical item — such as a car, painting or building — or a digital item — such as a digital photograph, digital blueprint or digital land title.DBAs include a large variety of assets that are uniquely identified in a digital environment and derive their value from multiple factors such as their scarcity, and their intrinsic and extrinsic value.

- Intrinsic value — Value is derived from the asset itself, such as precious metals, land, buildings and equipment.

- Extrinsic value — Value is derived from the asset’s instrumental purpose and how it relates to other DBAs (its complementary value), such as how stablecoins facilitate cryptocurrency trading and settlement.

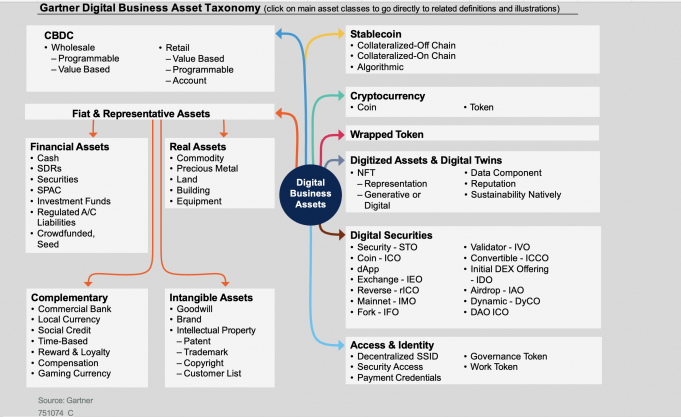

In this note, we map the different asset classes and define them as well as their constituent or subsidiary classes. Financial services CIOs can then use that understanding with executive colleagues to determine whether or not to pursue opportunities in this new area, and what capabilities are needed to compete. Gartner’s Digital Business Asset Taxonomy provides a foundational tool to identify and organize new types of assets and their role in the broader context of decentralized finance (DeFi), the programmable economy, and the future of money and commerce (see Figure 1).Figure 1: Gartner Digital Business Asset Taxonomy

Analysis

The downloadable Gartner Digital Business Asset Taxonomy Mapping, Definitions and Illustrations tool includes a workbook that maps each component of the taxonomy of Figure 1 to definitions and illustrations. The Gartner Digital Business Asset Taxonomy provides a way for financial services CIOs to assess adoption paths and the relevance and viability of digital asset use cases:

- The first tab of the tool — Digital Business Asset Map — introduces the different categories and classes of digital assets.

- The second tab of the tool — Digital Business Asset Def. — identifies and defines the main components for each asset class.

- An additional tab — Complementary Concepts Def. — introduces key concepts and technologies supporting digital assets.

Analyze the Impact of DBAs on Your Market

The emergence of new DBA classes results from the combination and interactions of multiple factors which are disrupting existing monetary and commercial exchanges, and customer engagement. The first step in assessing DBAs’ potential impact is to understand such factors and define their relevance for your given market. These factors may include:

- Digital business adoption, driven in part by the COVID-19 health crisis, is propelling changes in commercial and leisure interactions and, therefore, value exchange.

- More sophisticated digital technologies and algorithms are being deployed, resulting in the emergence of the programmable economy that demands new types of value exchanges and financing models, as well as a focus on the type of actors conducting commerce — such as smart machines (see The Programmable Economy is Driving a New Growth Reality and Business Opportunities).

- Blockchain-related acceleration of the evolution of digital token protocols that facilitate value exchange in the programmable economy.

- We define digital tokens as a representation of assets such as money, data or identity. The underlying asset can be in digital or physical form.

- For blockchain-enabled tokens, the underlying smart contract defines how the tokens can be acquired, exchanged or transferred, whether they are fungible or not, and their redemption or withdrawal conditions (transferability to another currency or fiat money).

- Increased experimentation in and deployment of DeFi, non-fungible tokens (NFTs) and the underlying blockchain technology, especially using smart contracts that support coins and tokenization via public blockchains.

- Acceleration of central bank digital currencies (CBDCs) initiatives, and notably wholesale CBDCs that support atomic transactions such as delivery vs. payment, hence easing the settlement of digital tokens and coins and the valuation and exchange of assets.

- Creation of alternative digital exchanges, such as NFT marketplaces, that drive issuance, and the continued growth of interest in cryptocurrencies and stablecoins with a combined market value of $2.37 trillion as of 8 December 2021.1

- Growth in interest in gaming and metaverses, which promote the use of digital assets and tokenized exchange of value. While such digital environments are still at an early stage and the value of tokens is volatile:

- As of 24 February 2022, Axie Infinity and Decentraland tokens had respective market values of $2.7 and $4.2 billion.1

- Roblox generated $130 million for developers for F3Q21, and, at the time of the publication of their F3Q21 report, claimed this would grow to more than $500 million for 2021.2

- Pop star Ariana Grande is reported to have been seen by one million users during her 2021 Fortnite virtual appearance.3

Use the Digital Business Asset Taxonomy to Engage With Your Business Peers

DBAs are supporting the emergence of DeFi, which itself is an important component of the development of the larger programmable economy (see How to Model the Programmable Economy to Assess Digital Business Growth Opportunities).Market interest and innovation in assets has intensified, not least as evidenced by an increase in Gartner client inquiries. Understanding asset classes and use cases is, therefore, essential to capture new revenue growth sources that the programmable economy presents. As a result, financial services CIOs must ensure that they understand the various classes of DBAs and that such concepts are well-understood across their organization. This means CIOs in particular must engage with chief product officers, CFOs and chief legal counsels. Financial services CIOs in particular must prepare their IT architecture and system stacks to accommodate the evolution of DBAs. Gartner’s Digital Business Assets Taxonomy offers financial services CIOs a foundational starting point and provides a contextual backdrop against which business initiatives that use such assets should be pursued. By using the taxonomy, CIOs and their business peers should explore the following critical questions:

- Do you have an awareness and minimum understanding of all the digital asset classes introduced in the taxonomy? If not, use the Digital Business Asset Taxonomy to familiarize yourself and your business peers with the new asset classes.

- Do you and your organization have visibility on the extent to which your clients currently use each of these DBA classes? If not, expose the Digital Business Asset Taxonomy to your clients to capture their understanding of the various asset classes as well as their current adoption levels.

- Have you reviewed and estimated the potential impact on new product opportunities and your enterprise and industry as clients increase usage of such asset classes? If not, taking into account the exposure of the Digital Business Asset Taxonomy to clients, appraise the implications in terms of customer retention and acquisition of launching new products, such as issuance, custody or trading solutions, for the new asset classes.

- Do you have dedicated roles (or a dedicated operation) in charge of monitoring the emergence of new digital asset classes? If not:

- Create a head of digital asset position as illustrated by Citi and Goldman Sachs.4,5

- Establish a steering committee with your business peers, using the Digital Business Asset Taxonomy to define coverage and responsibilities across business units.

- Have you reviewed how your existing risk management capabilities cope with the new asset classes and across various roles, such as issuance, custody and trading? If not, expose your risk management practice to the Digital Business Asset Taxonomy to establish where to prioritize risk management updates.

Undertake a Technology Capability Assessment to Analyze the Viability of Your Existing Systems

To extract value, such as by designing and delivering appropriate products to customers, CIOs must first analyze this interest in the context of the larger ecosystem of monetary assets. For example, Nike acquired RTFKT to issue virtual sneakers by using NFTs in emerging metaverses such as the Sandbox, providing gamers with equipment and apparel for their avatars.6 This will impact payment, custody and investment opportunities.Gartner’s Digital Business Assets Taxonomy helps financial services CIOs better understand specific market terms as well as the relationship between those terms which allows for more meaningful discussions about and exploration of use cases. Sub-categorization within the taxonomy highlights interdependencies such as between NFTs, branding, DeFi and metaverses. These relationships and the individual categories can change, and leaders need to keep this information current and consistent to avoid investment wastage due to the development of poor or inappropriate product architecture.Financial services CIOs should also use the Digital Business Asset Taxonomy to identify trading, settlement and combination opportunities across asset classes. For example, by identifying how:

- Stablecoins, CBDCs and cryptocurrencies can settle other digital assets, with a focus on securities and investment funds (financial assets), security token offerings (digital securities), and NFTs (digitized assets and digital twins)

- Access and identity DBAs such as decentralized self-sovereign ID or security access tokens enable the access and identification of ownership of the other DBA classes. For example, how to use a SSI to provide access to a data component (digitized assets and digital twins).

- Complementary DBAs can contribute to improved value exchanges across ecosystems. For example, gaming currencies and their role to settle payment for NFTs.

Following this step, CIOs should appraise how their existing applications can cope with the new demand, such as whether there is a need to modernize trading systems and/or enhance portfolio management capabilities.

Plan for Tokenization of Existing DBAs and the Creation of New Asset Classes

As the use of DBAs increases within the enterprise, extracting value is only going to be realized if information about the assets and their uses can be found, appropriately analyzed and aligned to the right technology solutions. When planning for the issuing or exchanging of, or the custody services supporting, DBAs, tokenization is a fundamental construct that financial services CIOs need to master. The Digital Business Asset Taxonomy provides them with illustrative examples to:

- Define where the tokenization of corporate assets would best apply, and for which type of assets to prioritize use cases

- Define and refine the impact of tokenization for key financial functions such as issuance, custody and trading, and therefore reprioritize research and developments as well as prioritize IT investments

- Demonstrate that tokenization is not new, but the adoption of blockchain technology has widened the contributors and participants to financial innovations

- Challenge executives to accept that customers would like to deal with new digital assets including cryptocurrencies — while demonstrating that the digital asset opportunity is not just about Bitcoin

- Explore how existing currency and assets will benefit from the new tokenization mechanisms and DeFi protocols

Evidence

As a result of Gartner client inquiries and interactions, Gartner performed a review of the classes of DBAs over the last two years in order to create the mapping introduced in this document. Through client and industry interactions, we validated the relevance to our clients of each asset class as well as the illustrations provided. 1 Today’s Cryptocurrency Prices by Market Cap, CoinMarketCap.2 Roblox Reports Third Quarter 2021 Financial Results, Roblox.3The Metaverse Takes Shape as Several Themes Coverage, Global X.4Citi to Hire 100 People in Push Into Digital-Assets, Bloomberg. 5Goldman Names New Head of Digital Assets in Bet That Blockchain Is the Future of Financial Markets, CNBC.6Nike, Inc. Acquires RTFKT, Nike.